7/15/2015

Illinois: Fake Bankruptcy Filing Releases Cars From ImpoundMan figures out that cars are automatically freed from impound lots when a Chapter 7 bankruptcy petition is filed.

Municipalities in the Chicago, Illinois region generate substantial revenue through impounding cars with outstanding parking and red light camera tickets. Authorities grab over 50,000 automobiles each year, creating $25 million in profit from the $500 charge to release the vehicles -- an amount that does not include the required full payment of back penalties.

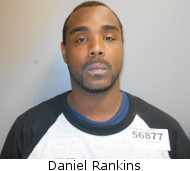

Daniel Rankins, 32, realized that residents who could not afford the thousands required to pay the fees and fines could still get their car back by filing for bankruptcy. Rankins last week was sentenced to eighteen months in prison for charging $600 to file bogus petitions that helped at least eighty drivers retrieve their rides.

"What he came up with was a pretty sophisticated system," US District Judge Robert M. Dow Jr said of the scheme. "He could have found a better way to apply himself."

What Rankins noticed, to the dismay of local officials, was that nobody actually read the bankruptcy filings. It was only after a finance department clerk noted about a thousand vehicles had been freed from the impound without paying the associated fines and fees that the agency began to suspect that something was amiss. Investigators set up a sting operation on January 7, 2013 to catch "Little D," the alias used by Rankins.

An undercover cop approached Rankins claiming that he owed Chicago $4200 and that he would be willing to pay $600 to get his car back. Rankins filled out paperwork designed to remove Chicago's legal claim to hold the agent's supposed property. For this, Rankins was charged with bankruptcy fraud.

To qualify for federal bankruptcy under Chapter 7, a debtor must file a document listing of all his assets and liabilities, all his income and expenses, and all his creditors. Normally, there is a $306 fee to file this material, but fees can be waived for impoverished debtors. As federal prosecutors explained, federal law forced the city to release the automobiles when a motorist produced a receipt proving that he had filed a bankruptcy petition.

"The filing of a petition under Chapter 7 automatically stayed most collection actions against the debtor or the debtor's property," the US attorney's office explained in its indictment. "The stay arose by operation of law and required no judicial action."

Rankins provided a partially completed Chapter 7 filing, a bankruptcy fee waiver form and a document certifying completion of a "credit counseling" course that was never actually taken. The forms listed no assets other than the particular vehicle in the Chicago impound lot. The motorist would then sign the form and turn it in. While the technique would likely work in other major cities, Chicago says it has taken steps to read some bankruptcy filings.

"As a result of office of inspector general and FBI work, the law department is now working more closely with the US Trustee's Office to carefully screen suspicious bankruptcy petitions before releasing an impounded vehicle whenever the owner submits proof of bankruptcy," Chicago Inspector General Joseph M. Ferguson explained.