1/2/2008

Virginia: New Year Brings New Motorist TaxesNorthern Virginia motorists will now pay an extra $300 million in taxes imposed by an unelected regional authority.

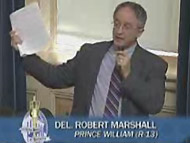

As of yesterday, Northern Virginia motorists began paying $300 million in new taxes designed to allow the legislature to increase spending on social projects. Last year, the same bipartisan legislative compromise that created the unpopular civil remedial fees also created the Northern Virginia Transportation Authority (NVTA). This unelected body was handed the authority to raise taxes on drivers without involving elected lawmakers. State Delegate Robert Marshall (R-Prince William) lambasted the bill that created the taxing authority on the House floor just prior to its adoption because it allowed NVTA members to impose new taxes after an election.

"I cannot vote for this bill because there are too many subterfuges in here trying to avoid responsibility and accountability," Marshall said. "Members of these regional governments -- and they are regional governments -- don't even have to vote on this until December. What's interesting about December? It's a month and a half after the election. They can all promise 'I'm not going to vote to raise any taxes' and then afterward they can vote to do it."

The authority did vote to hike taxes, adding an extra 2 percent tax on the cost of renting a car; an extra $10 fee added to the cost of annual car inspections; a 5 percent tax on the cost of repairing an automobile; an extra $10 fee to register a car; and a fee equal to 1 percent of a car's value the first time it is registered. Non-motorist fees include a tax on the sale of homes of $400 for every $100,000 of the home's value and a 2 percent tax hike on hotel rooms.

Although the NVTA also allocates money to regional transportation projects, the legislature routinely takes money out of transportation funds so that much of the money raised in the name of transportation is actually used to shore up spending on social projects. Marshall has proposed a constitutional amendment to prohibit the practice of "treating taxpayers as bottomless ATM machines" by raiding transportation funds. Thus far, the amendment has failed to achieve the full support of lawmakers.

That has not stopped Delegate Marshall and other NVTA opponents like Loudoun County from acting to stop the legislature's taxpayer-funded spending spree. On January 8, the state supreme court will hear arguments against the taxing authority likely to focus on a state constitutional provision that bars unelected bodies from imposing taxes.

"No ordinance or resolution... imposing taxes, or authorizing the borrowing of money shall be passed except by a recorded affirmative vote of a majority of all members elected to the governing body," Article 7, Section 7 states.

The new taxes apply in Alexandria, Arlington, Fairfax County, Falls Church, Loudoun County, Manassas, Manassas Park and Prince William County.